Executive MicroSD and TF cards Summary

The global MicroSD (Micro Secure Digital) and TF (TransFlash) cards wholesale market has experienced significant growth over the past decade, driven by escalating demand for portable storage solutions across consumer electronics, automotive, surveillance, and industrial sectors. This report provides a comprehensive analysis of the wholesale ecosystem, including market size, key players, pricing trends, supply chain dynamics, and emerging opportunities. With a focus on bulk procurement strategies, manufacturing hubs (notably China), and evolving technological standards, this study equips wholesalers, distributors, and OEMs with actionable insights to optimize their market positioning.

MicroSD TF Cards wholesale

1. Introduction

1.1 Definition and Scope

- MicroSD vs. TF Cards: Clarifying terminology (TF cards, introduced by SanDisk in 2004, were later rebranded as MicroSD under the SD Association’s standardization).

- Applications: Smartphones, dashcams, drones, IoT devices, gaming consoles (Nintendo Switch), and embedded systems.

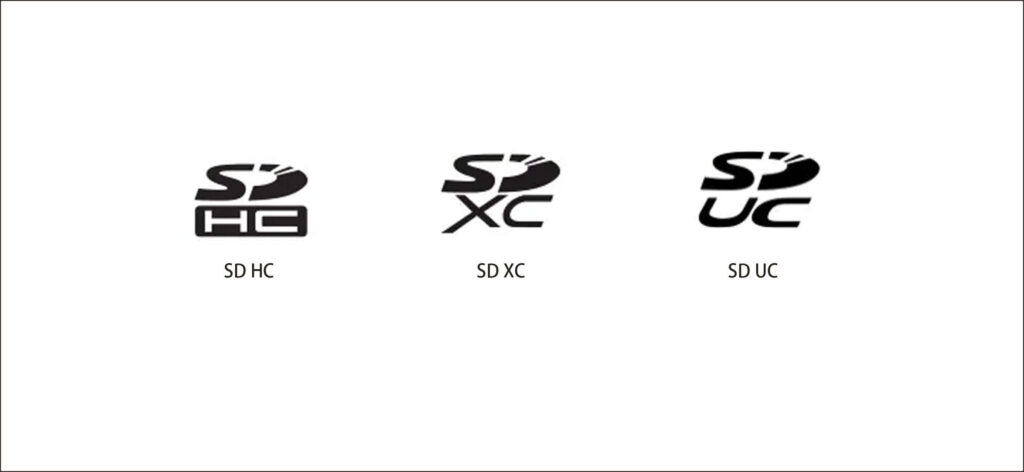

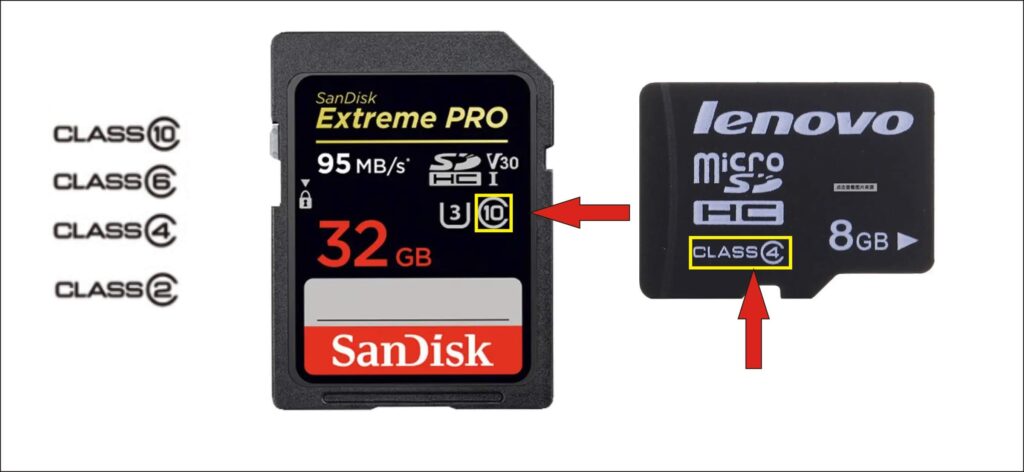

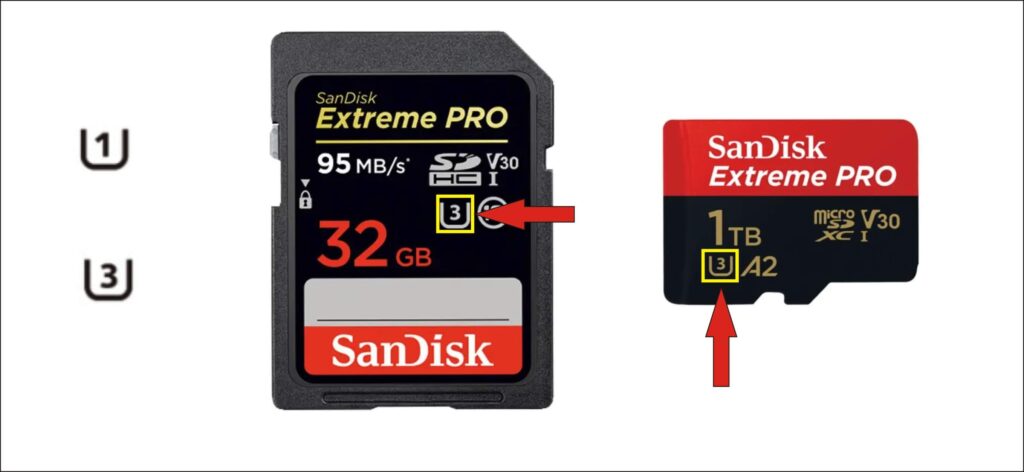

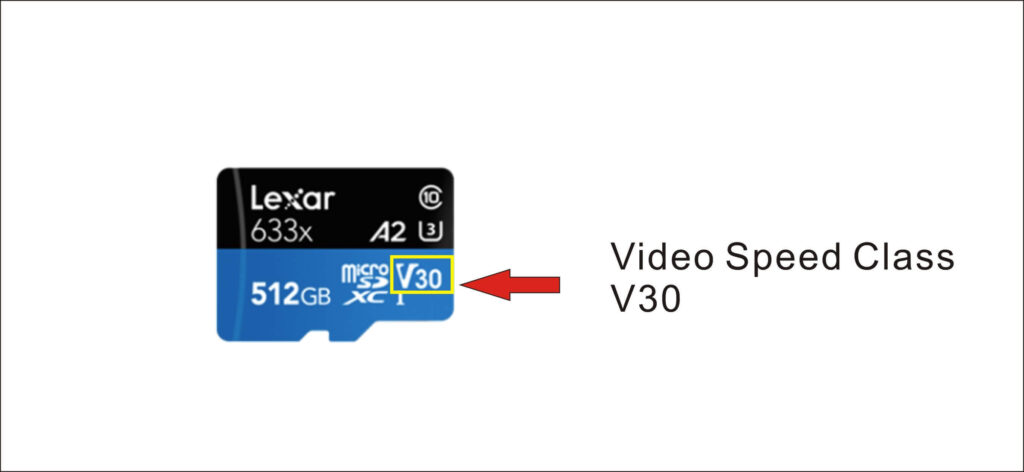

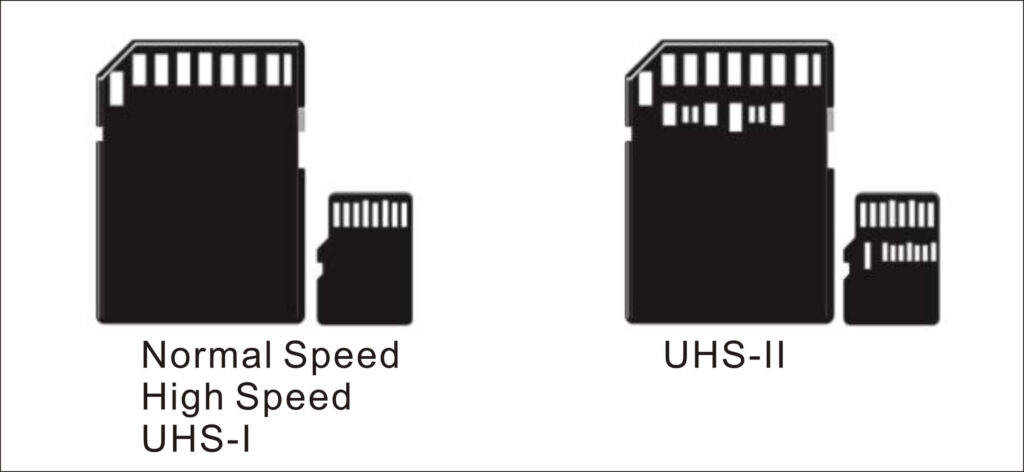

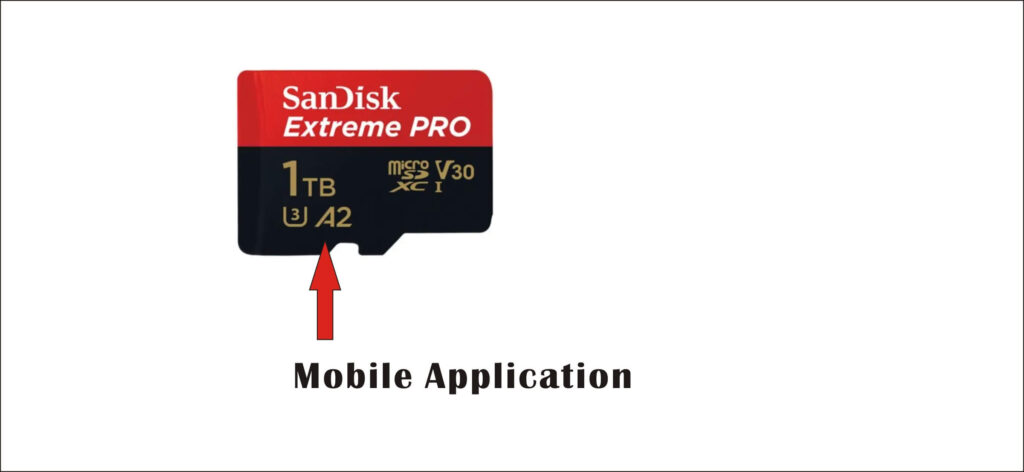

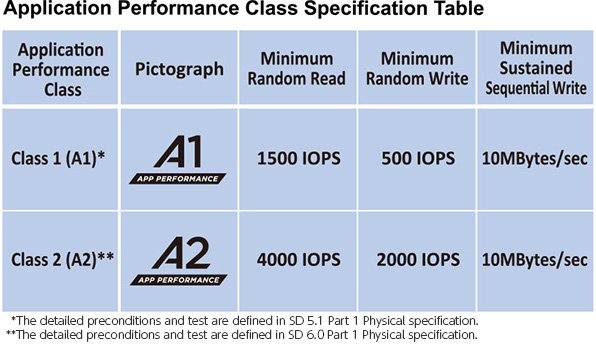

- Wholesale Market Segmentation: By capacity (32GB–1TB), speed class (UHS-I, UHS-II, A1/A2), end-use industry, and distribution channel (B2B platforms, trade shows, OEM contracts).

1.2 Objectives

- Analyze pricing strategies for bulk purchases.

- Evaluate the dominance of Chinese manufacturers in global supply chains.

- Forecast demand trends linked to 4K video, 5G, and AI-driven devices.

2. Global Market Overview

2.1 MicroSD and TF cards Market Size and Growth (2023–2030)

- 2023 Valuation: $5.2 billion (MicroSD/TF cards wholesale), CAGR of 8.7% (2024–2030).

- Demand Drivers:

- Proliferation of high-resolution cameras (dashcams, bodycams).

- Expansion of budget smartphone markets (Africa, Southeast Asia).

- Automotive infotainment and telematics systems.

2.2 Regional Analysis

- Asia-Pacific (45% market share): China dominates manufacturing (70% of global output), with hubs in Shenzhen, Shanghai, and Hong Kong. Key buyers: Indian and Vietnamese OEMs.

- North America (25%): High demand for UHS-II cards (4K surveillance, gaming). Major wholesalers: Ingram Micro, Synnex.

- Europe (20%): Strict compliance with RoHS/CE standards; growth in industrial IoT applications.

Memory Cards MicroSD TF wholesale China

3. Supply Chain and Manufacturing Landscape

3.1 Key Players in Wholesale

- Tier 1 Manufacturers: Samsung, SanDisk (Western Digital), Kingston, Lexar (Longsys), Toshiba Kioxia.

- Chinese OEM/ODM Suppliers: Netac, TECLAST, PNY Technologies (Shenzhen-based factories), providing low-MOQ (500–1,000 units) customization.

- Distributors: Amazon Business, Alibaba B2B, DHgate, specialized electronics wholesalers.

3.2 Cost Structure Analysis

- Components: NAND flash memory (60% of cost), controllers, packaging.

- Wholesale Pricing:

- 32GB Class 10: $1.20–$1.80/unit (MOQ 10,000).

- 256GB UHS-I A1: $8.50–$12.00/unit (MOQ 5,000).

- Premium 1TB UHS-II: $85–$120/unit (MOQ 1,000).

3.3 Quality and Compliance Challenges

- Counterfeit Mitigation: RFID tagging, holographic packaging, and blockchain-based verification (e.g., Kingston’s anti-fraud system).

- Certifications: SD Association compliance, waterproof/dustproof (IP68), extreme temperature resilience (-25°C to 85°C).

4. Wholesale Procurement Strategies

4.1 Sourcing Models

- Direct Factory Contracts: Negotiating with Chinese ODMs for branded/white-label production.

- B2B Marketplaces: Alibaba.com, Made-in-China.com (average 15–30% lower pricing vs. Western distributors).

- Trade Shows: Canton Fair, CES (Las Vegas), and IFA Berlin for networking with Tier 2 suppliers.

4.2 Logistics and Inventory Management

- Shipping: Air freight for urgent orders (3–5 days) vs. sea freight (30–45 days) for cost-sensitive bulk.

- Tariffs: US Section 301 tariffs (25% on Chinese imports) incentivizing Southeast Asian diversification (e.g., Thai/Vietnamese assembly).

5. Emerging Trends and Opportunities

5.1 High-Performance Storage Demands

- 4K/8K Video: UHS-II/UHS-III cards with V60/V90 speed classes (min. 60MB/s–90MB/s write speeds).

- A2 App Performance: Random read/write speeds for Android apps (e.g., GoPro’s recommended specs).

5.2 Niche Markets

- Automotive: MIL-STD-810G-certified cards for dashcams (Tesla, Bosch partnerships).

- Industrial IoT: SLC NAND cards for write-intensive applications (10+ year endurance).

5.3 Sustainability Initiatives

- Recycled Materials: Bio-based plastics in packaging (SanDisk’s EcoLine series).

- Refurbished Cards: Wholesale markets for recertified industrial-grade cards.

6. Risk Analysis

- Price Volatility: NAND flash oversupply (2023–2024) leading to 20% price drops.

- Geopolitical Risks: US-China tech decoupling impacting semiconductor supply chains.

- Technological Disruption: Cloud storage adoption vs. edge storage needs.

7. Future Outlook (2025–2030)

- AI-Driven Forecasting: Dynamic pricing algorithms for wholesalers.

- Advanced Packaging: 3D NAND stacking for 2TB+ MicroSD cards.

- 5G Synergy: Real-time data caching in smart cities/autonomous vehicles.

MicroSD TF cards Chinese manufacturers

8. Conclusion

The MicroSD/TF memory cards wholesale market remains a high-growth, competitive arena shaped by innovation and cost-efficiency. Wholesalers must prioritize partnerships with compliant Chinese Memory Cards manufacturers, adopt agile procurement models, and align inventory with emerging tech trends (UHS-II, A2, industrial IoT). By leveraging data-driven logistics and diversification strategies, stakeholders can capitalize on the $8.3 billion market opportunity projected by 2030.

Appendices

- Appendix A: Top 20 MicroSD/TF Card Manufacturers in China (2024)

- Appendix B: Sample Wholesale Price List (MOQ Tiers)

- Appendix C: Compliance Checklist (CE, FCC, RoHS)